Clarksburg Sees Tax Rate Drop, Tax Bills RiseBy Tammy Daniels, iBerkshires Staff

01:13AM / Thursday, November 30, 2017 | |

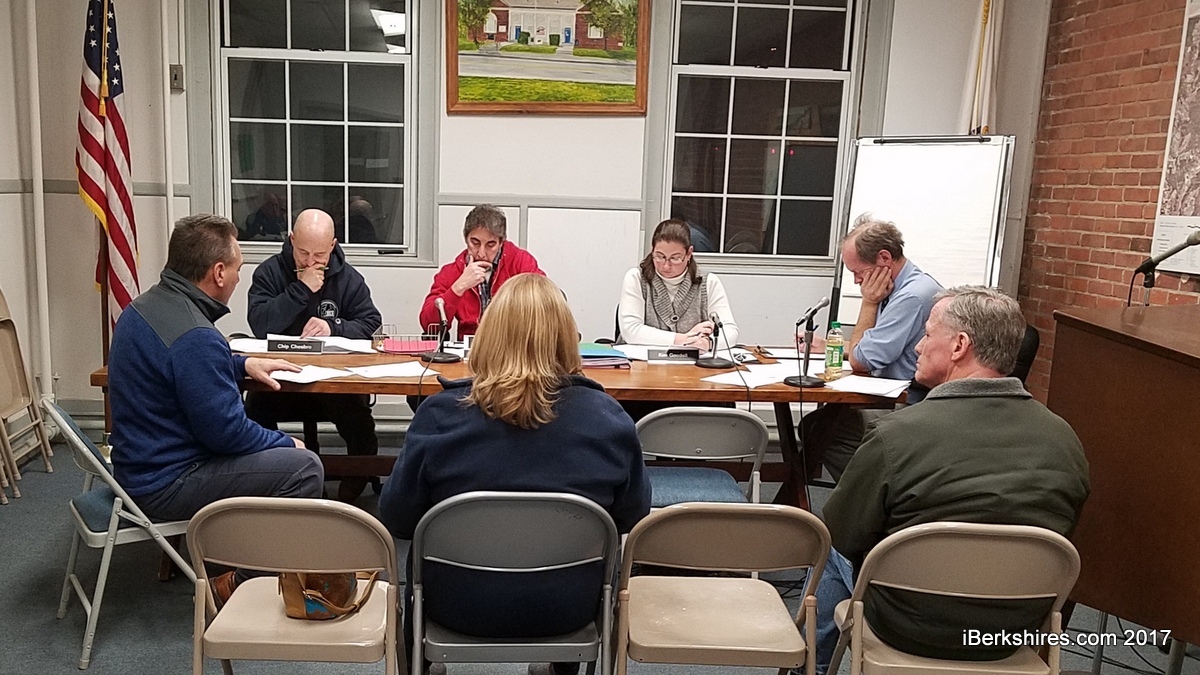

Town Assessor Ross Vivori explains how the tax rate was calculated to the Select Board. Town Assessor Ross Vivori explains how the tax rate was calculated to the Select Board. |

CLARKSBURG, Mass. — Property owners will see their tax rate go down but their bills will go up.

The Select Board on Wednesday approved a tax rate of $15.31 per $1,000 assessed value, down 50 cents over last year, for fiscal 2018. But the average bill will still jump $108.

Assessor Ross Vivori said the town usually gains $8,000 to $12,000 from annual growth but this past year it gained more than $30,000 on $2 million in new growth.

The town's total assessed value also increased dramatically, by $9 million, showing a strong recovery from the falling values of several years ago.

"I wasn't forecasting that number earlier," Vivori told the board.

However, the town's budget continues to be tight. It's been essentially level-funded over the past years and fiscal 2019 is expected to start off with a deficit.

Clarksburg has also barely skirted its maximum tax levy. Despite a $95,000 increase in the total tax levy, the town's excess capacity is only $1,000.

"You guys are pretty much right up there near the limit," Vivori explained. "In fact, your capacity, your excess levy capacity, is only $1,046. You're pretty much right at the max."

The town has a maximum tax levy of $1,889,162 and has to raise $1,888,116 to fund the fiscal 2018 budget.

The increase in property values — bringing them back up to 2011-12 levels — has raised the value of the average single-family home up to $169,724.84. That's about $12,000 more than last year. Vivori explained that if the values had not gone up, the rate would have been around $16.

Select Board member Carlyle "Chip" Chesbro said it seemed counterintuitive for rates to go down and bills to go up. He asked if the town had to lower the rate.

Vivori said, yes. "You have to do what the math tells you," he said.

The tax bill for an average home would be $2,599, up 4 percent over last year.

In other business, the board accepted a bequest of $5,000 from the estate of Doris Roberts and voted to create a trust account for the money. Roberts, a resident, died in July at age 91. The library trustees will also have to vote to accept the funds, which can be used for whatever the library needs.

The board also welcomed Mark Denault back to the Finance Committee. Denault had chaired the committee for several years but stepped down more than a year ago when other members also left. The committee has been fallow since then with only James Stakenas being appointed. Moderator Bryan Tanner, responsible for appointing the committee, has had difficulty finding replacements and is still seeking a third member.

Clarksburg Tax Rate Fiscal 2018 by iBerkshires.com on Scribd

|